cumulative preferred stock formula

The preferred stock is cumulative. The formula shown is for a simple straight preferred stock that does not have additional features such as those found in convertible retractable and callable preferred stocks.

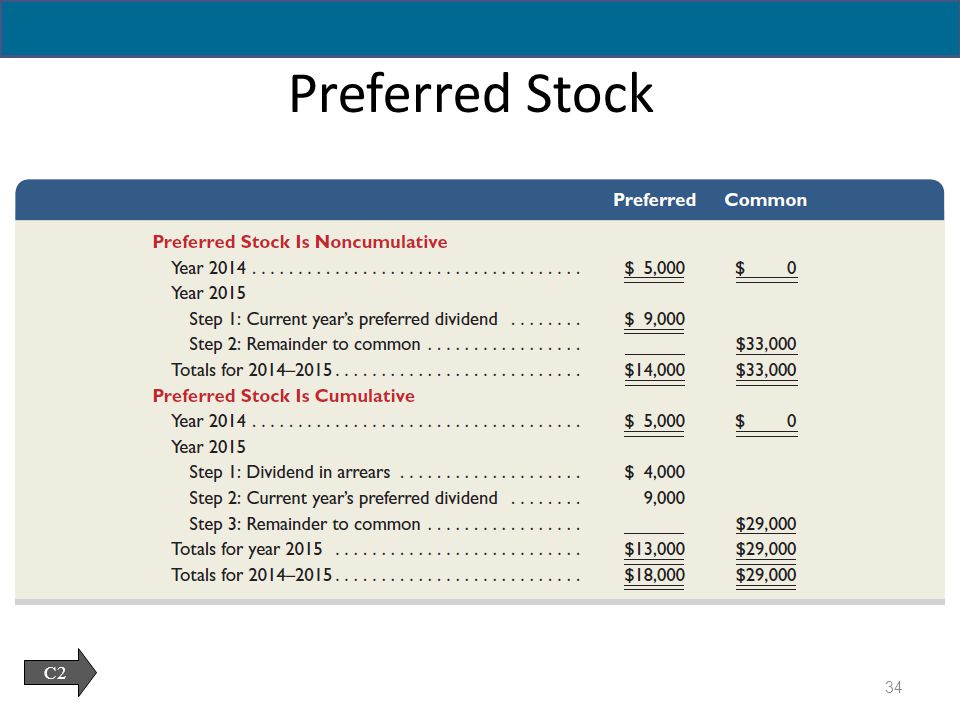

Common And Preferred Stock Principlesofaccounting Com

The preferred stock dividends formula is par value x dividend rate x position skipped dividends.

. Par value of one share of preferred. The cumulative in cumulative preferred stock means that if your company suspends dividend payments the unpaid dividends known as dividends in arrears owed continue to accrue. Find out preferred dividends paid in each year and.

If the preferred shares have dividends of 8 per value of stock and the market value of each stock is 80. Heres an easy formula for calculating the value of preferred stock. In this case we have the rate of dividend and par value is given now we can calculate a preference dividend using the formula.

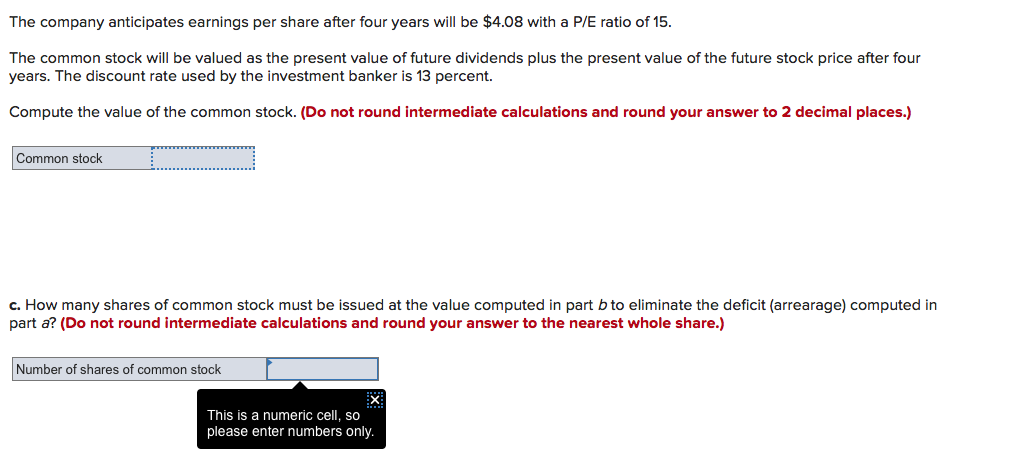

First calculate the preferred stocks annual dividend payment by multiplying the. If net income for the 2015 2016 and 2017 were 45 million 85 million and 10 million. Rp DY1 preferred stock dividend in year 1 P preferred stock price Growth rate.

160000 06 9600 1. If the preferred stock is noncumulative. Preferred Dividend Formula Number of preferred.

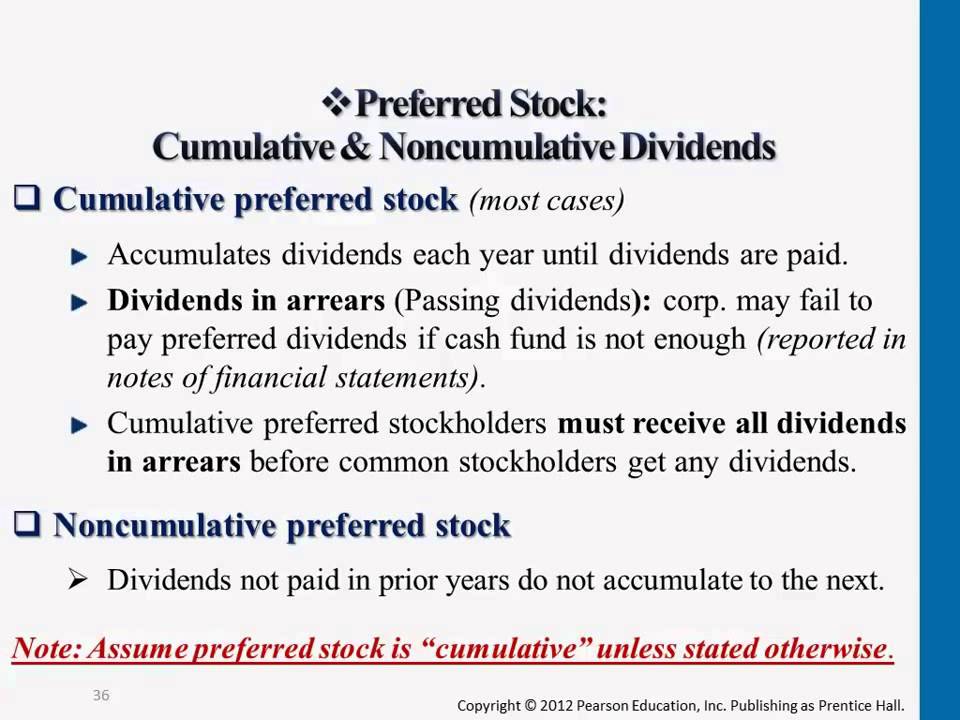

Preferred stock can be cumulative preferred stock where an investor is entitled to the current years dividends as well as all dividends in arrears or outstanding dividends from previous. Rp cost of preferred stock with growth DY1preferred stock dividend at year 1 P preferred stock price Growth rate So lets look at an example highlighted by the Corporate Finance. Annual non cumulative preferred stock dividends 30 x 015 x 10000.

Annual non cumulative preferred stock dividends 45000. If Colin were to purchase 1000 preferred shares of ABC Company assuming. However since it is the quarterly dividend payment we.

Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P. Preferred stocks usually pay dividends quarterly. Preferred dividend Par.

There are several simple formulas an investor in cumulative preferred stock should know. The expected dividends of the investor can be calculated as. On the preferred stock prospectus he notices that the dividend rate is 5 with a par value of 100.

The Corporate Finance Institute featured an example with a 2 growth rate and a 3 dividend. Since the preferred stock is. Annual dividend on preferred stock.

The preferred stock is cumulative.

Preferred Stock Financial Edge

Solved Enterprise Storage Company Has 570 000 Shares Of Cumulative Course Hero

Accounting For Corporations Ppt Download

Cumulative Dividend Definition Formula How To Calculate

Solved Enterprise Storage Company Has 400 000 Shares Of Chegg Com

Preferred Stock Cumulative Noncumulative Dividends Youtube

Solved Dividends Per Share Seventy Two Inc A Developer Of Radiology Course Hero

Solved Enterprise Storage Company Has 430 000 Shares Of Chegg Com

Cumulative Preferred Stock And Examples The Financial Falconet

:max_bytes(150000):strip_icc()/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

What Are Preference Shares And What Are The Types Of Preferred Stock

Common And Preferred Stock Principlesofaccounting Com

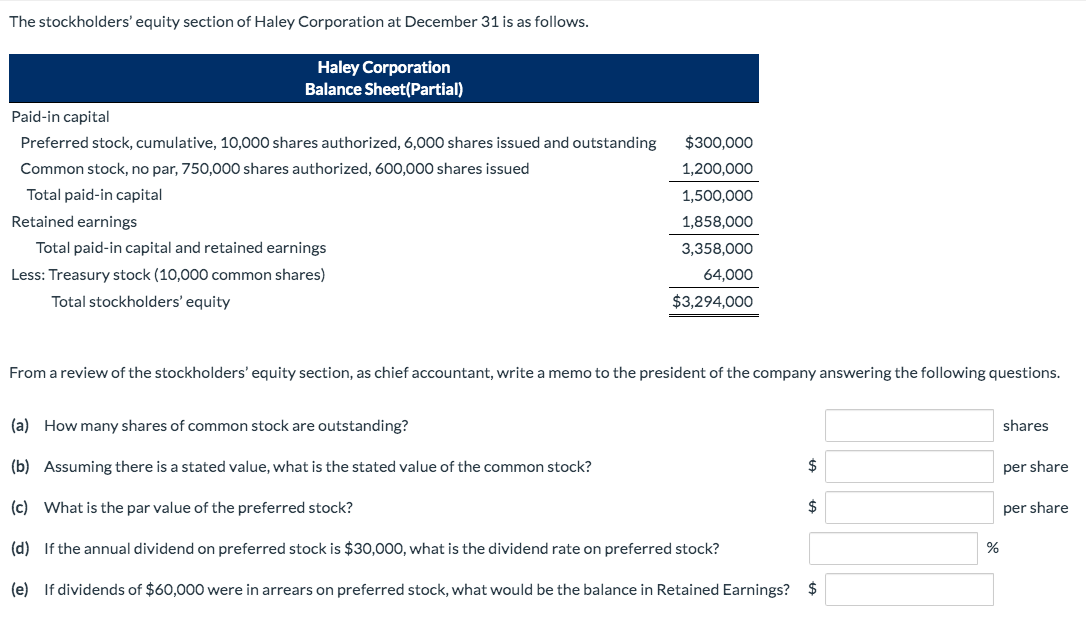

Answered The Stockholders Equity Section Of Bartleby

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

Chapter 11 Understanding Formulas Flashcards Quizlet

Preferred Shares Meaning Examples Top 6 Types

Accounting For Corporations Ppt Download

How To Calculate The Price Of Preferred Stock For A Startup Abstractops

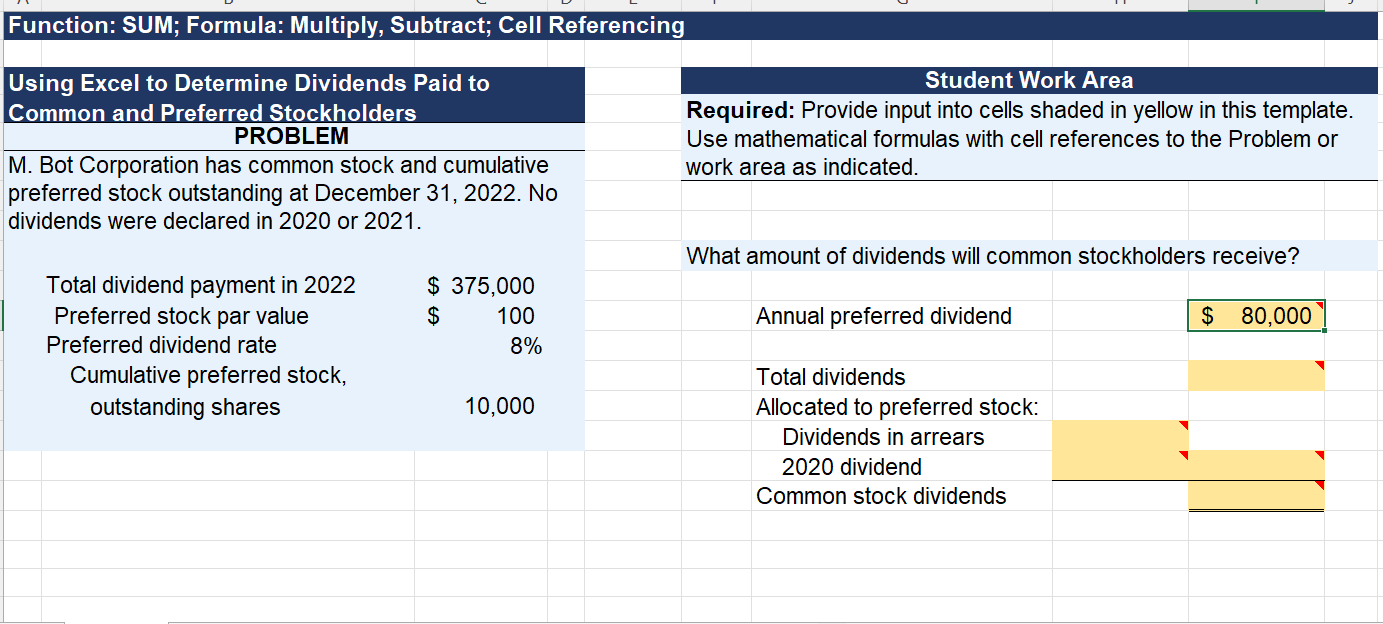

Solved Function Sum Formula Multiply Subtract Cell Chegg Com