nassau county property tax rate 2020

Complete guide covering the Nassau County property tax rate county town village school taxes due dates Nassau County property search payments more. 3 discount if paid in the month of December.

New York Property Tax Calculator Smartasset

Access property records Access real properties.

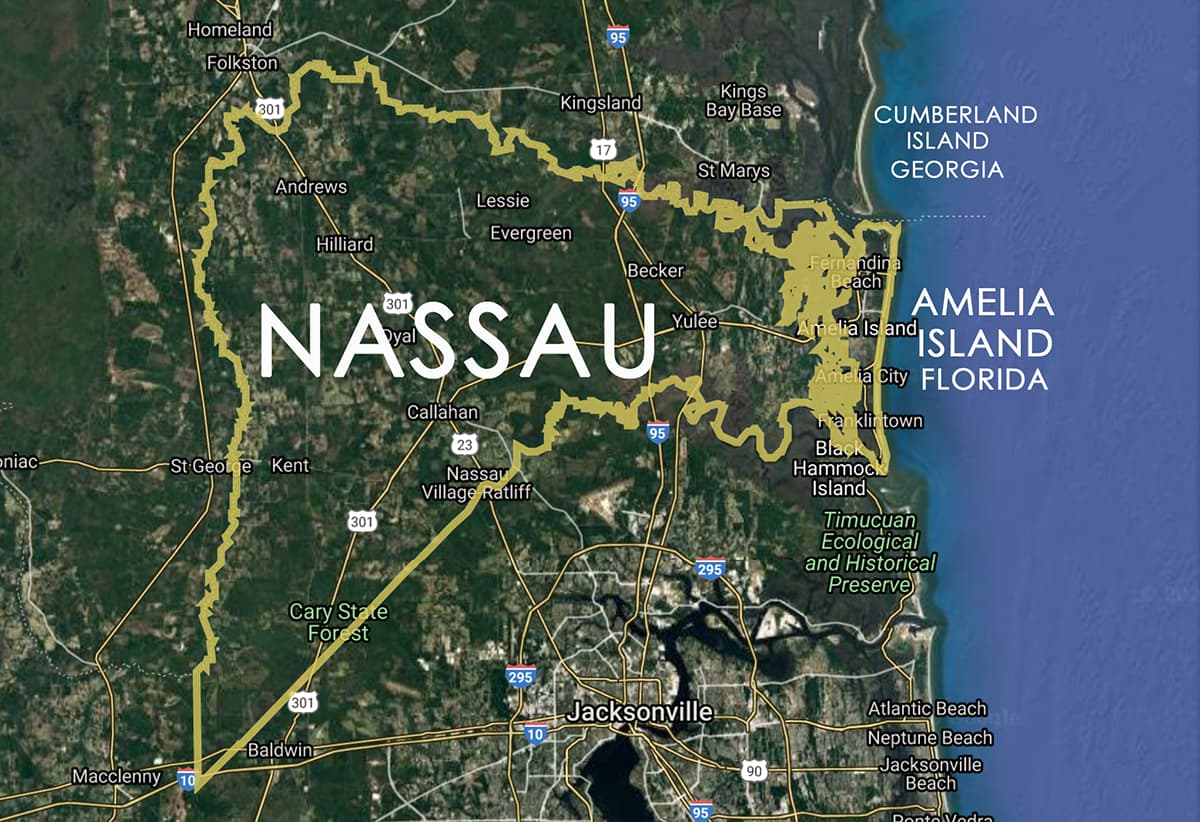

. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. Visit Nassau County Property Appraisers or Nassau County Taxes for more information. 2022 Homeowner Tax Rebate Credit Amounts.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. If you would like. Calculate the Estimated Ad Valorem Taxes for your Property.

Schedule a Physical Inspection of Your Property. Nassau County collects on average 074 of a propertys assessed. You may pay your current tax bill by credit card or electronic check online.

If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter to. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your.

The median property tax in Nassau County New. The 2021 Nassau County property tax rate was 515 per 1000 of full market value plus municipal tax rates for towns andor villages school district taxes and taxes for. Nassau County property taxes are assessed based upon location within the county.

4 discount if paid in the month of November. 1 discount if paid in the month of. If you have previously filed a tax grievance and have had a successful tax reduction for the 201819 or 202021 years Nassau County will not be using that information for deferment.

For over 10 months County Executive Curran has urged the Nassau County Legislature to call for a vote and finally approve the plan. Last summer the County posted a hypothetical. Nassau County Department of Assessment 516 571.

Nassau County Tax Lien Sale. Nasssau County Florida Tax Collector. If the check amount.

The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the. Payment by credit card will incur a convenience fee of 23 of your total tax payment. Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance.

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Nassau County collects on average 179 of a propertys assessed. Nassau county property tax rate 2020 Wednesday August 24 2022 Edit.

Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021 plus town taxes of 003 to 1805. The owners of the listed. 2 discount if paid in the month of January.

Below is a town by town list of NJ Property tax rates in Atlantic County.

Property Taxes By County Interactive Map Tax Foundation

81 Voter Turnout In Conservative Nassau County Amelia Island Living

A Michael Hickox Nassau County Property Appraiser Yulee Fl Facebook

Property Taxes By County Where Do People Pay The Most And Least

Who Pays Taxes In Fernandina Beach An Opinion Fernandina Observer

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

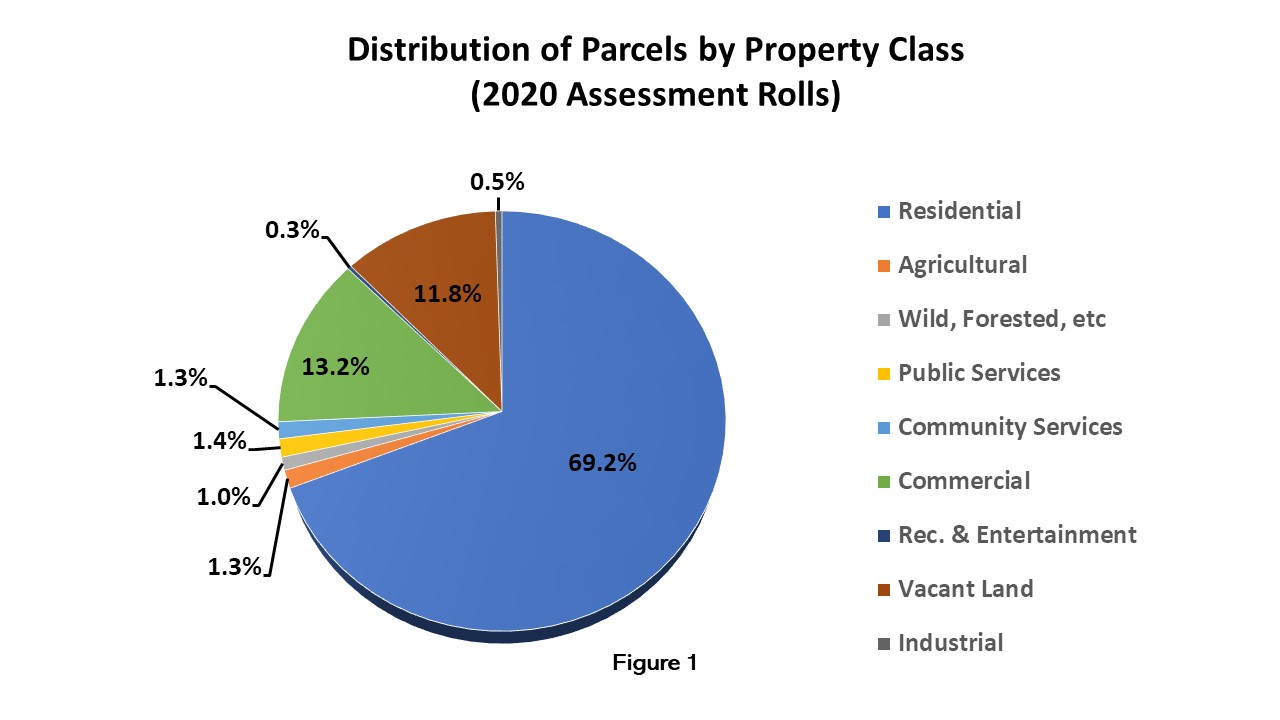

Distribution Of Parcels By Property Class 2020 Assessment Rolls

Audit Tax Appeal Firms Made 500m During Past Assessment Freeze Newsday

Nassau County Property Tax Reduction Tax Grievance Long Island

Homeowners In Houston Do Better When They Protest Property Taxes On Their Own

Tax Grievance Appeal Nassau County Apply Today

Florida Property Tax H R Block

2022 Property Taxes By State Report Propertyshark

Property Tax By County Property Tax Calculator Rethority

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

The Tax Levy Limit When Is 2 Not Really 2

Nassau County Tax Rate Hike Despite Property Values Zooming Amelia Island Living

New York Property Taxes By County 2022

Nassau County Proposed Budget 2021 Unveiled Mineola Ny Patch